Analysis of Climate and Energy Provisions in the “Inflation Reduction Act of 2022”

Last updated August 2, 2022

Author: Justin McCarthy, Climate Policy Associate (justin@progressivecaucuscenter.org)

Introduction

On July 27, 2022, Senate Majority Leader Chuck Schumer (D-NY) and Senator Joe Manchin (D-WV) announced a deal to significantly expand the scope of Senate Democrats’ planned reconciliation bill. The agreement, titled the Inflation Reduction Act of 2022 (H.R. 5376), would raise an estimated $739 billion in revenue over 10 years and spend $433 billion, reducing the deficit by approximately $306 billion over a decade.

The expanded legislation now contains $369 billion in climate and energy provisions, including nearly $280 billion in clean energy tax incentives. This would constitute the largest-ever U.S. investment in climate action and is designed to accelerate the buildout of renewable energy, speed up the adoption of electric vehicles (EVs), and aid in the deployment of energy efficiency technologies in low-income and minority communities. Together, these long-term investments in clean energy would reduce inflation, lower household energy bills, and help reduce U.S. dependence on fossil fuels, particularly foreign oil. According to multiple analyses by Rhodium Group and Energy Innovation, its passage would put the U.S. on a credible path to achieving a roughly 40% reduction in greenhouse gas emissions by 2030.

The Senate is expected to vote on the budget reconciliation agreement as soon as next week. Majority Leader Schumer released the following statement on Wednesday, July 27: “I expect that the remaining work with the parliamentarian will be completed in the coming days and the Senate will vote on this transformative legislation next week.” Because Senate Democrats plan to advance this bill via reconciliation to avoid the filibuster, the Senate’s parliamentarian must advise on whether the bill adheres to reconciliation’s strict rules before it moves to the Senate floor.

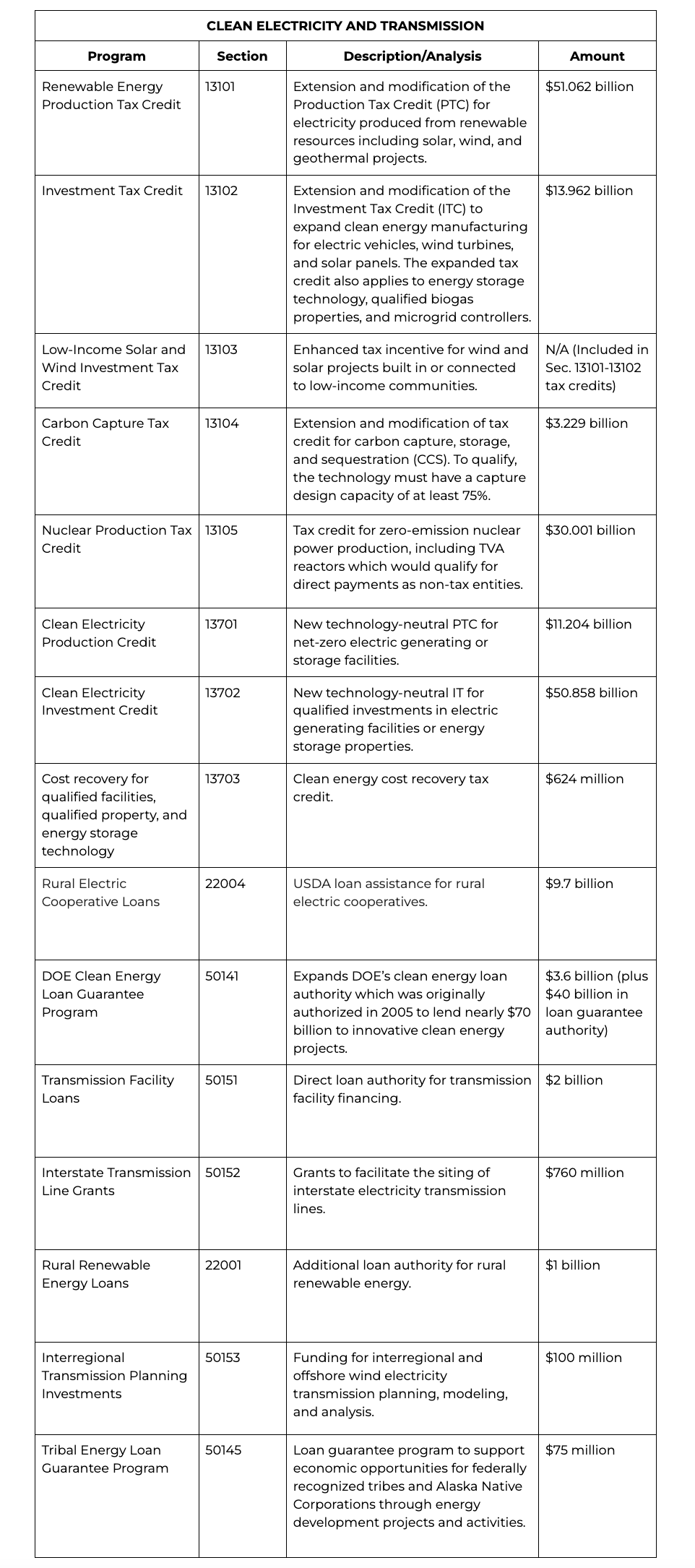

Clean Electricity and Energy Transmission

The Inflation Reduction Act includes $121 billion in clean electricity tax incentives to supercharge the installation of renewable energy to the grid and reduce household energy bills. While gas prices are a major driver of inflation — accounting for almost one-third of price increases since the pandemic began — clean energy sources such as wind and solar actually have a deflationary effect on the economy. Specifically, the legislation includes enhanced Investment and Production Tax Credits, an enhanced credit for renewable energy projects built in low-income communities, and a series of federal grant and loan programs to build energy transmission projects around the country.

The clean energy tax incentives found throughout the legislation also include prevailing wage requirements and still provide direct pay eligibility for rural electric co-ops, government agencies, and other non-tax entities. However, the refundability of these tax incentives has mostly been eliminated, which will limit their overall effectiveness and accessibility. Without the refundability mechanisms, low- and middle-income households that do not owe enough in federal income taxes cannot receive the full value of the credits.

Clean Transportation

The Inflation Reduction Act contains historic investments to decarbonize the transportation detector, including $22.6 billion in tax incentives and $3 billion to electrify the U.S. Postal Service’s (USPS) delivery fleet.

Specifically, the Inflation Reduction Act extends the $7,500 tax credit for the purchase of a new EV and $4,000 for the purchase of a used EV. Currently, the EV tax credit includes a cap of 200,000 vehicles sold per manufacturer, meaning companies like Tesla and GM no longer qualify for the federal tax credit. The legislation eliminates this cap. To qualify for the tax credit, however, automakers are required to manufacture EVs using minerals that are extracted or processed in countries with U.S. free trade agreements and utilize batteries that include a large percentage of components manufactured or assembled in North America. Finally, eligibility for the EV tax credits would be capped to an income level of $150,000 for a single filing taxpayer and $300,000 for joint filers for new vehicles at $75,000 and $150,000 for used cars. Despite the importance of the bill's investments in clean transportation, the Inflation Reduction Act prioritizes automobile transportation with no meaningful investments for electric bikes or public transit.

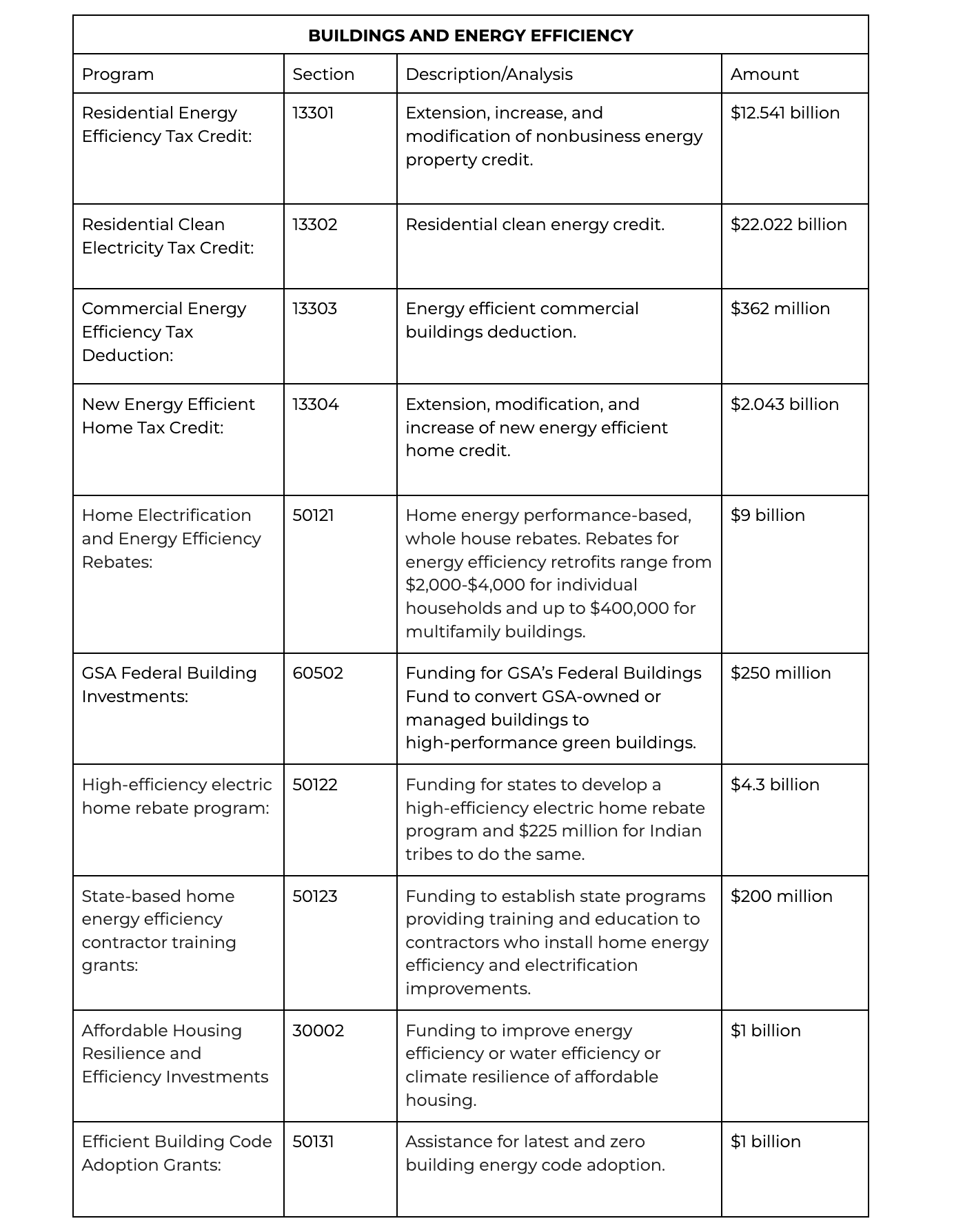

Buildings and Energy Efficiency

Currently, buildings are responsible for 40% of global energy consumption and 33% of greenhouse gas emissions. Reducing energy consumption and improving energy efficiency in homes, offices, factories, and schools is one of the fastest and most effective ways to achieve significant greenhouse gas emissions reductions. The Inflation Reduction Act makes wide-ranging investments in efficiency across buildings, industry, and transportation, that will create new jobs, reduce carbon emissions, and save consumers and businesses money.

Manufacturing

The Inflation Reduction Act provides $50 billion in tax incentives to boost domestic clean energy manufacturing of solar panels, wind turbines, batteries, and the processing of critical minerals mineral processing, as well as an additional $11.5 billion for industrial emissions reduction programs. The legislation also provides $500 million for the Defense Production Act to boost the manufacturing of energy-efficient technologies such as heat pumps. In June, President Biden invoked the Defense Production Act to accelerate domestic manufacturing in the renewable energy sector. Together, these provisions would create good-paying union jobs, reduce energy prices, and help relieve supply chain bottlenecks.

Environmental Justice

Low-income communities and communities of color are disproportionately exposed to toxic pollution from toxic dumps, power plants, and other industrial facilities concentrated in their neighborhoods. The Inflation Reduction Act makes investments in a wide range of program areas including clean air, clean transportation, and the cleanup of toxic pollution. Moreover, the legislation would allocate $27 billion for the establishment of a Greenhouse Gas Reduction Fund. Modeled after the success of state and local green banks, the Greenhouse Gas Reduction Fund is designed to provide low-cost financing for clean energy infrastructure projects around the country. There is still room for improvement, however. For example, many agencies have yet to finalize guidance to ensure compliance with President Biden’s Justice40 Initiative.

Conservation and Agriculture

Last year alone, the United States faced 22 extreme weather and climate-related disaster events with losses exceeding $1 billion each — a cumulative price tag of nearly $100 billion. The Inflation Reduction Act makes historic investments in climate resilience programs that conserve our natural resources, promote biodiversity, harden critical infrastructure, and prepare communities for extreme weather events including wildfires, droughts, and hurricanes. Together, both bills would bring us closer to achieving the America the Beautiful Initiative, a national goal of conserving at least 30 percent of U.S. lands and oceans by 2030 commonly referred to as “30 by 30.”

The legislation also invests nearly $20 billion in conservation programs at the U.S. Department of Agriculture (USDA), including $8.45 billion for the Environmental Quality Incentives Program (EQIP) and $6.75 billion for the Conservation Stewardship Program (CSP). These programs are included in the Farm Bill, which Congress must reauthorize in 2023. Given this increase in funding, it is essential that these programs are reshaped to eliminate wasteful spending and ensure maximum impact. Currently, it is estimated that less than 20% of EQIP spending goes to climate-smart conservation practices that actually reduce greenhouse gas emissions.

Fossil Fuels

Below-market leasing rates and outdated royalty rates encourage further exploitation of our public lands by fossil fuel companies, leaving taxpayers and future generations on the hook for the environmental damage. The Inflation Reduction Act includes numerous commonsense oil and gas reforms such as increasing royalty and rental rates, eliminating noncompetitive leasing, and establishing minimum bids on federal parcels. The current onshore royalty rate of 12.5% has not been updated since the Mineral Leasing Act was signed into law by President Woodrow Wilson in 1920 and is dramatically lower than the rates charged by states and private landowners — in some cases by up to 25%. The legislation addresses methane emissions, a powerful greenhouse gas that is 25 times as potent as carbon dioxide at trapping heat in the atmosphere. Methane represents 10 percent of all U.S. greenhouse gas emissions, primarily from natural gas extraction and livestock agriculture.

Unfortunately, the legislation would also require oil and gas leasing in the Gulf of Mexico and Alaska, reinstate an illegal 2021 Gulf lease sale, and lock in oil and gas lease sales as a precondition for the approval of federal renewable energy projects. The greenhouse gas emissions associated with continued fossil fuel leasing will offset some of the emissions reductions found elsewhere in the legislation.

Other Agreements

According to a summary released by Senate Democrats, the terms of the budget reconciliation agreement also included a commitment to pass “comprehensive permitting reform” for major infrastructure projects before the end of the fiscal year. Senate Majority Leader Chuck Schumer subsequently indicated that lawmakers plan to attach these permitting reforms to a stopgap bill to keep the government running past September 30, 2022. This part of the deal, which was reportedly essential to securing Senator Manchin’s support for IRA, must move separately because it would run afoul of the strict budget rules for reconciliation. To pass the Senate, it must be voted on separately and will require 60 votes.

According to a framework obtained by the Washington Post, the reforms would impose hard deadlines for the permitting of major infrastructure projects, limit legal challenges to future projects, and speed the approval of the Mountain Valley Pipeline (MVP). The pipeline’s construction is ongoing but has been delayed by litigation. A 2017 analysis from Oil Change International estimated that approval of the MVP would result in 90 million metric tons of greenhouse gas emissions annually — equivalent to 26 coal plants or 19 million cars. The following reforms were also included in the outline.

1. Presidential designation and prioritization of permitting for at least 25 high-priority energy infrastructure projects.

Require that the list be balanced by project type: critical minerals, nuclear, hydrogen, fossil fuels, electric transmissions, renewables, and CCS.

The criteria for selecting designation projects would include: reducing consumer energy costs, decarbonization potential, and promoting energy trade with our allies.

2. Expand eligibility for the Federal Permitting Improvement Steering Council (FPISC) to ensure that smaller energy projects, critical minerals and mining, and other key programs can benefit from FPISC.

Improve the process for developing categorical exclusions under the National Environmental Policy Act (NEPA) and would require a single interagency environmental review document and concurrent agency review processes.

3. Modify Section 401 of the Clean Water Act.

Require one of four final actions within one year of certification requests; grant, grant with conditions, deny, or waive certification.

Clarify that the basis of review is water quality impacts from the permitted activity, based on federal, state, and tribal standards.

Prohibit state or tribal agencies from requesting project applications to withdraw applications to stop/pause/restart the certification clock.

Require states and tribes to publish clear requirements for water quality certification requests, or else default to federal requirements.

4. Restrict access to the courts

Set statute of limitations for court challenges.

Require that if a federal court remands or vacates a permit for energy infrastructure, the court must set and enforce a reasonable schedule and deadline, not to exceed 190 days, for the agency to act on and remand.

5. Clarify Federal Energy Regulatory Authority (FERC) jurisdiction regarding the regulation of interstate hydrogen pipeline, storage, import, and export facilities.

6. Enhance federal government permitting authority for interstate electric transmission facilities that have been determined by the Department of Energy (DOE) to be in the national interest:

Replace DOE's national interest electric transmission corridor process with a national interest determination that allows FERC to issue a construction permit.

Require FERC to ensure costs for transmission projects are allocated to customers that benefit.

Allow FERC to approve payments from utilities to jurisdictions impacted by a transmission project.

7. Complete the Mountain Valley Pipeline: Require relevant agencies to take all necessary actions to permit the construction of the Mountain Valley Pipeline and give the DC Circuit jurisdiction over any further litigation.