The CEO Pay Problem and What We Can Do About It

Authors: Sarah Anderson, Institute for Policy Studies; Alan Barber, CPC Center

How big are today’s CEO-worker pay gaps?

Why are extreme CEO-worker pay gaps a problem for our society and economy?

Why is executive “pay for performance” a myth?

What do the American people think about CEO-worker pay gaps?

How big are today’s CEO-worker pay gaps?

In 2022, the ratio between CEO compensation at S&P 500 firms and average U.S. worker pay stood at 272-to-1, according to AFL-CIO analysis. The CEOs in this group averaged $16.7 million, while average worker pay stood at $61,900.

Using a slightly different methodology and sample, the Economic Policy Institute found that CEOs were paid 344 times as much as a typical worker in 2022, up from an average pay ratio of just 21 to 1 in 1965.

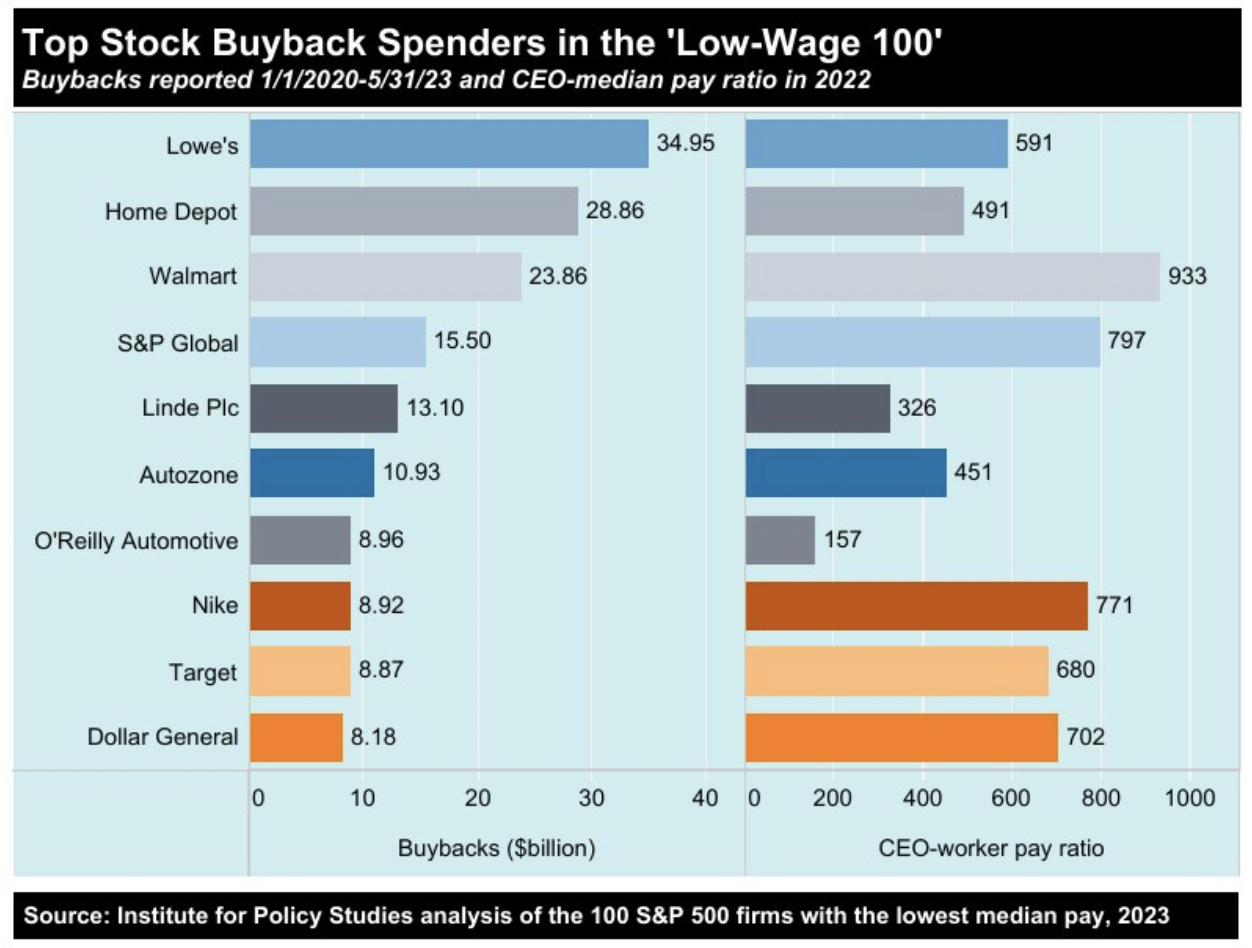

An Institute for Policy Studies report zeroed in on the 100 S&P 500 corporations with the lowest median worker pay levels in 2022. CEO pay in these “Low-Wage 100” firms averaged $15.3 million, and median worker pay averaged $31,672 in 2022. The average CEO-worker pay ratio in this group was 603 to 1.

Why are extreme CEO-worker pay gaps a problem for our society and economy?

Economic inequality: CEO-worker pay gaps are a powerful driver of our country’s extreme economic inequality. Between 2009 and 2019, incomes for the richest 0.1 percent of Americans grew 3.5 times as fast as those for the bottom 90 percent of earners. CEOs dominate that top income tier, with average compensation in 2021 nearly eight times as high as wages for the top 0.1 percent, according to Economic Policy Institute analysis. As White House economic advisor Heather Boushey has said, inequality drags the nation’s economic growth. The concentration of income and wealth also leads to excessive political power in the hands of a privileged few.

Racial and gender inequality: Extreme pay disparities widen gender and racial gaps since women and people of color make up a disproportionately large share of low-wage workers and a tiny share of corporate leaders. In 2022, women held only slightly more than 10 percent of Fortune 500 CEO positions while making up 63.5 percent of workers earning the federal minimum wage. Black CEOs currently lead just 8 percent of Fortune 500 corporations.

Executive recklessness: CEO pay practices incentivize reckless behavior that puts us at risk. For example, executives chasing huge bonuses crashed our economy in 2008, leaving millions of Americans homeless and jobless. In the three years leading up to the meltdown, the top five executives at the 20 biggest bailed-out banks averaged $32 million in compensation. The Institute for Policy Studies has documented how the CEO pay system has perversely rewarded executives for other harmful behaviors, including slashing jobs, cooking the books, accelerating climate change, and dodging taxes.

Bad for business: Extensive academic research has shown that extreme pay disparities undermine the corporate bottom line by reducing employee morale and productivity and raising turnover rates. A Harvard Business School study of S&P 1500 firms, for example, found that companies with overpaid CEOs and underpaid workers saw significantly higher levels of employee dissatisfaction and turnover and lower sales. Treasury Secretary Janet Yellen co-authored a landmark paper on how large pay disparities cause resentment among lower-level employees, leading them to quit or not give their all on the job. The Institute for Policy Studies has compiled a bibliography of studies from business schools and management consulting firms that draw similar conclusions.

Why is executive “pay for performance” a myth?

For decades, studies have shown that skyrocketing CEO pay levels have nothing to do with improved managerial performance. One Wall Street Journal analysis and another by the corporate governance firm MSCI found that higher-performing CEOs had lower median pay than their peers. An annual report by the investor advocacy group As You Sow has consistently found that the 100 “most overpaid” CEOs lag the S&P 500 in total financial returns.

Rather than an indicator of high performance, massive CEO paychecks reflect a rigged system that extracts wealth from ordinary workers and channels profits to the top of the corporate ladder. Some common tactics:

1. Using stock buybacks to artificially inflate CEO paychecks

All employees contribute to company profits. But instead of broadly sharing the wealth, companies increasingly use stock buybacks — a once-illegal form of market manipulation — to make those at the top of the corporate ladder even richer.

In 2021 and 2022, S&P 500 corporations spent record sums repurchasing their stock, a maneuver that artificially inflates the value of a company’s stock by reducing the supply on the open market. These buybacks, in turn, inflate CEO paychecks since the bulk of executive compensation is in some form of stock-based pay. In 2022, the Economic Policy Institute found that stock-related pay (exercised stock options and vested stock awards) accounted for 81.3 percent of average realized CEO compensation.

Every dollar spent on stock buybacks is a dollar not spent on worker wages, research and development, and other productive investments that would stimulate long-term growth. Analysts have thoroughly documented the association between buybacks and reduced capital investment and innovation, wage stagnation, and worker layoffs.

The Institute for Policy Studies recently took a deep dive into buyback activity among the 100 S&P 500 corporations with the lowest median wages. Between January 1, 2020, and May 31, 2023, fully 90 percent of these firms spent company resources on buybacks, for a total expenditure of $341.2 billion. During their stock buyback spree, the value of CEOs’ personal stock holdings at these ‘Low-Wage 100’ firms increased more than three times as fast as their median worker pay.

2. Claiming that equity-based pay ensures “pay for performance”

CEO pay apologists often point to the multi-year vesting periods for stock awards and stock option grants as proof that executive pay plans encourage responsible leadership for the long haul and discourage short-term recklessness.

But most companies hand out these grants every year. This timing turns so-called “long-term” incentives into invitations for short-term maneuvers to boost share values by any means necessary — from slashing jobs and safety standards to flooding communities with opioids.

In bull markets, even the most inept corporate leaders can ride the rising tide and reap huge windfalls by cashing in their equity compensation. Oil company CEOs, for instance, have benefited massively when foreign wars or other factors entirely beyond their control have driven up the global price of oil — and their companies’ share prices.

At the pandemic's peak, corporate boards demonstrated how easily they could dispense with the “pay for performance” façade altogether. An Institute for Policy Studies analysis of 100 large, low-wage firms found that over half moved bonus goalposts or took other actions in 2020 to artificially pump up executive paychecks while their workers suffered from the Covid crisis.

What do the American people think about CEO-worker pay gaps?

Morning Consult conducted a poll in September 2023 at a moment when striking UAW workers were garnering big headlines with demands for wage hikes on par with CEO pay raises in their industry. A key finding: 62 percent of Americans agreed with the statement, “Worker pay should be increased whenever CEO pay is increased to prevent inequality.”

A 2022 Just Capital poll found that 62 percent of Republicans and 75 percent of Democrats would support an outright cap on CEO pay relative to worker pay, regardless of company performance. Public support for capping executive pay has been building since a 2016 Stanford Business School survey found 52 percent of Republicans and 66 percent of Democrats favoring pay limits.

The Just Capital poll shows that 87 percent of Americans view the growing gap between CEO and worker pay as a problem, and just 13 percent think CEOs of large U.S. corporations are paid the “right amount.”

What are Congress and the executive branch already doing to rein in CEO pay — and what more could be done?

Reining in CEO pay will require multiple strategies. Worker organizing can be a potent force for fair pay practices, and unions are increasingly raising this issue in contract negotiations like the recent UAW strike. Shareholders can also flex their power, and in fact, last year, more shareholders used non-binding “say on pay” votes to express opposition to executive pay packages than ever before.

But, excessive CEO pay is not just a worker or shareholder issue. We need responsible public policy to steer Corporate America in a more equitable direction that will benefit the entire country. The following section highlights CEO pay-related reforms in four areas where we see signs of momentum: tax, stock buybacks, subsidy/procurement, and Wall Street pay policies. A much more extensive menu of policy options is available in the appendix to this Institute for Policy Studies report.

POLICY SOLUTION: CEO pay-related tax reforms

Enacted:

The American Rescue Plan Act of 2021 denies corporations tax deductions for all compensation in excess of $1 million going to any of their top 10 executives.

A regulation in force since 2018 has required U.S. publicly held corporations to annually report the ratio between their CEO and median worker compensation. This disclosure rule sparked federal, state, and municipal efforts to tie the pay ratio to tax policies. These reforms aim to create an incentive to both rein in executive pay and lift up worker wages, all while generating significant new revenue for vital public investments.

In 2016, Portland, Oregon adopted a surtax of 10 percent on companies operating in the city that have CEO-worker pay gaps of 100 to 1 or higher and 25 percent if the ratio is 250 to 1. San Francisco’s similar “Overpaid Executive Tax” became effective on January 1, 2022, with revenue expected to be about $125 million per year.

Key Legislative proposals:

The Curtailing Executive Overcompensation (CEO) Act, introduced on November 2, 2023, by Senate Budget Committee Chair Sheldon Whitehouse and House Democrats Alexandria Ocasio-Cortez and Barbara Lee, would apply an excise tax to publicly traded and private companies that have above a 50:1 CEO-to-median-worker pay disparity. Under the excise tax formula, the rate owed would be proportional to the degree the company’s pay ratio exceeds 50:1 and to the level of the CEO’s compensation. In other words, if a company has a large pay gap, they would owe extra taxes, and if they also have extremely high CEO pay, they’d owe even more. In 2022 alone, the bill would have raised more than $10 billion from the Fortune 100 largest U.S. companies, according to Senate Budget Committee staff estimates.

The Tax Excessive CEO Pay Act (S. 794/H.R.1979), a bill championed by Sens. Bernie Sanders (D-VT) and Elizabeth Warren (D-MA) and Reps. Barbara Lee (D - CA -12) and Rashida Tlaib (D-MI-13), would tie a company’s federal corporate tax rate to the size of the gap between their CEO and median worker pay. Tax penalties would begin at 0.5 percentage points for companies that pay their top executives between 50 and 100 times more than their median workers. The highest penalty would apply to companies that pay top executives over 500 times worker pay. The bill would raise an estimated $150 billion over ten years. Rep. Mark DeSaulnier’s (D-CA-10) CEO Accountability and Responsibility Act (H.R. 3301) would impose similar tax penalties for large pay ratios.

The CEO and Worker Pension Fairness Act (S.3341), also introduced by Sen. Sanders (D-VT), addresses tax loopholes that allow executives to shelter unlimited amounts of compensation in special tax-deferred accounts. These exclusive accounts are one factor in the yawning gap between CEO and worker retirement benefits. Under this bill, executives would owe taxes on their compensation as soon as it vests.

The Stop Subsidizing Multimillion Dollar Corporate Bonuses Act, introduced on November 8, 2023, by Sens. Jack Reed (D-RI) and Richard Blumenthal (D-CT), would build on the loophole closure in the American Rescue Plan Act by extending the $1 million deductibility cap to all employees at publicly traded companies.

POLICY SOLUTION: Efforts to curb CEO pay-inflating stock buybacks

Enacted:

The 2022 Inflation Reduction Act introduced a 1 percent excise tax on CEO pay-inflating stock buybacks.

In 2022, the Department of Commerce announced plans to prioritize the awarding of new CHIPS subsidies for domestic semiconductor manufacturing to firms that do not engage in any stock buybacks. The Department of Commerce should expand this important step to all corporate recipients of federal contracts, grants, and subsidies.

In 2023, the SEC issued a new regulation requiring companies to include daily stock buyback expenditure information in quarterly reports rather than monthly totals. The U.S. Chamber of Commerce is suing to block the rule.

Key legislative proposals:

The Reward Work Act (HR 3694), championed by Rep. Chuy Garcia, would reinstate the general ban on stock buybacks in force before 1982.

President Biden proposed quadrupling the excise tax on buybacks in his 2023 State of the Union address. Senators Ron Wyden and Sherrod Brown have introduced the Stock Buyback Accountability Act (S. 413) to achieve this.

President Biden’s FY2023 and 2024 federal budget proposals, would ban top executives from selling their personal stock for a multi-year period after a buyback, preventing CEOs from timing share repurchases to cash in personally on a short-term price pop they themselves artificially created. A Senate bill, introduced by Sen. Elizabeth Warren, the ALIGN Act (S. 790), would do just that.

POLICY SOLUTION: CEO pay-related subsidy and procurement reforms

Enacted:

A 2013 budget deal cut the allowable reimbursement limit for executive compensation at federal contractors nearly in half; today, it stands at $619,000. However, this benchmark only limits the cash compensation a company can directly bill the government for reimbursement and does not curb the stock-based windfalls that government contracts generate for top executives. CEOs of leading contractors routinely haul in eight-figure paychecks that are hundreds of times larger than their typical worker pay.

The 2008 Government Funding Transparency Act requires privately held firms that rely heavily on federal contracts and subsidies to disclose their top executives’ pay. Previously, this disclosure requirement only applied to publicly held firms.

Key legislative proposals:

The Patriotic Corporations Act (H.R. 4186), championed by Rep. Jan Schakowsky (D-IL-09), would grant preferential treatment in contracting to firms with pay ratios of 100 to 1 or less, among other “high-road” benchmarks, including neutrality in union organizing campaigns. Rep. Mark DeSaulnier’s (D-CA-10) CEO Accountability and Responsibility Act (H.R. 3301) would provide similar preferences to encourage narrow pay ratios. The Congressional Progressive Caucus has called on President Biden to introduce such incentives.

Sen. Bernie Sanders (D-VT) released a Workplace Democracy Plan in 2019 that includes a ban on federal contracts to firms with CEO-worker pay ratios of more than 150 to 1 or that outsource jobs, pay workers less than $15 an hour, or engage in union-busting.

POLICY SOLUTION: Rein in Wall Street pay

Enacted:

The 2010 Dodd-Frank Financial Reform legislation included a provision (Section 956), which bans Wall Street incentive pay that encourages “inappropriate” risk-taking. Regulators have failed to implement this rule, despite continued financial recklessness, as Public Citizen has thoroughly documented. But under the Biden administration, the responsible agencies have been working to finalize this regulation.

Key legislative proposals:

Sen. Chris Van Hollen (D-MD) and Rep. Nydia Velazquez (D-NY-07) sent regulators a letter in April 2023 with specific proposals for rigorous implementation of the long overdue Dodd-Frank Wall Street pay restrictions. Their recommendations include a ban on stock options, long-term deferral of all bonus pay, and a requirement that executives personally pay the costs of fines resulting from recklessness.

The regional banking crisis of early 2023 led to a spurt of bipartisan Senate action to hold executives accountable. Senators Sherrod Brown (D-OH) and Tim Scott (R-SC) introduced legislation to enable the Federal Deposit Insurance Corporation to strip bonuses and stock compensation that executives took in the two years before a bank’s failure and impose on them a fine of up to $3 million. The Recovering Executive Compensation from Unaccountable Practices (Recoup) Act (S.2190) passed out of the Senate Banking Committee by a vote of 21 to 2 but has seen no further action.

Additional Resources

AFL-CIO:

Executive Paywatch (a searchable database of CEO pay, median worker pay, and pay ratios for Russell 3,000 firms)

Institute for Policy Studies:

Inequality.org CEO-worker pay gap resource page (facts, academic research, and federal, state, and municipal legislation)

Executive Excess 2023 (Report on CEO pay and stock buybacks at the 100 S&P 500 corporations with the lowest median worker pay levels)

Economic Policy Institute:

CEO pay slightly declined in 2022. But it has soared 1,209.2% since 1978 compared with a 15.3% rise in typical workers’ pay.

Public Citizen:

12 Years After Dodd-Frank, It’s Time for Financial Regulators to Finish Banker Pay Rules

Americans for Financial Reform and Take on Wall Street executive compensation resources and actions

Roosevelt Institute:

Regulating Stock Buybacks: The $6.3 Trillion Question

About the co-authors:

Sarah Anderson directs the Global Economy Project and co-edits the Inequality.org web site and weekly newsletter at the Institute for Policy Studies. She has co-authored more than 20 IPS annual Executive Excess reports and testified before the Senate Budget Committee on this issue in 2021 and 2012.

The Institute for Policy Studies (IPS-DC.org) is a progressive organization dedicated to building a more equitable, ecologically sustainable, and peaceful society. IPS has conducted path-breaking research on executive compensation for nearly three decades. The IPS Inequality.org website (Inequality.org) provides an online portal into all things related to the income and wealth gaps that so divide us, in the United States and throughout the world. Sign up for our weekly newsletter at: Inequality.org/subscribe. Twitter and Facebook: @inequalityorg

Alan Barber leads the CPC Center’s policy team and the Policy and Research Council, a coalition of think tanks, advocates, and experts dedicated to strengthening the progressive movement.

The Congressional Progressive Caucus Center (progressivecaucuscenter.org) is a 501(c)(3) nonprofit. We work to identify and build solidarity around policies that foster a more just, equitable, and resilient nation. We also demystify government so that every community is empowered to fight for change that will allow all of us to thrive. When national and grassroots organizations work together across issues, lawmakers and those in power are forced to listen. The CPC Center provides the infrastructure necessary for organizations across issues to work together and advance a shared vision of what people-centered policies should look like.