February 12, 2025: House vs. Senate: Comparing GOP Plans to Advance Trump’s Agenda

Last week, Senate Republicans took their first steps to tackle President Trump’s legislative agenda. Today, House Republicans followed suit, unveiling a budget that paves the way for more than $4 trillion in tax cuts for the rich and corporations, gargantuan cuts to health care and food assistance, as well as mass deportations and a giant boost to the already massive Pentagon budget. Below, I’ll break down the differences between the two chambers’ approaches and what to watch next.

Previously, on reconciliation watch…

Reminder: reconciliation is the process congressional Republicans plan to use to enact their agenda without Democratic support. To learn how, check out The Basics of Budget Reconciliation.

Republicans hope to use reconciliation to renew and expand corporate-friendly tax policies from the first Trump Administration set to expire later this year; greenlight hundreds of billions of dollars for the military and deportations; and to pair this new spending with massive cuts to programs like Medicaid, which provides health care to more than 70 million Americans.

The House and Senate disagree on a couple key points: 1) how deeply to cut programs families depend on, and 2) whether to do all this in one bill (House GOP leadership’s preference) or two (House Freedom Caucus and Senate GOP’s preference). More on why the one bill vs. two bills debate matters here.

Senate Republicans released a budget blueprint last week, which defined the universe of topics their reconciliation bill could potentially cover. Consistent with their favored two-bill approach, the blueprint doesn’t touch the President’s tax wishlist—a second bill would be necessary later this year to deal with that. The proposal directs committees to come up with at most $521 billion in new spending and at least $4 billion in cuts between Fiscal Years 2025-2034.

See our February 7 update for a deep dive into the Senate budget and the risk it poses to families’ health care, food assistance, and more.

What the House proposed today

The House’s budget blueprint tells committees to come up with at least $1.5 trillion in cuts, to be paired with $4.8 trillion in new spending, between Fiscal Years 2025-2034. The resolution also states that the goal is to hit $2 trillion in cuts—and if they can’t manage it, the amount of spending the Ways and Means Committee can do (that is, for tax cuts) will drop commensurately. This budget would also raise the debt limit by $4 trillion.

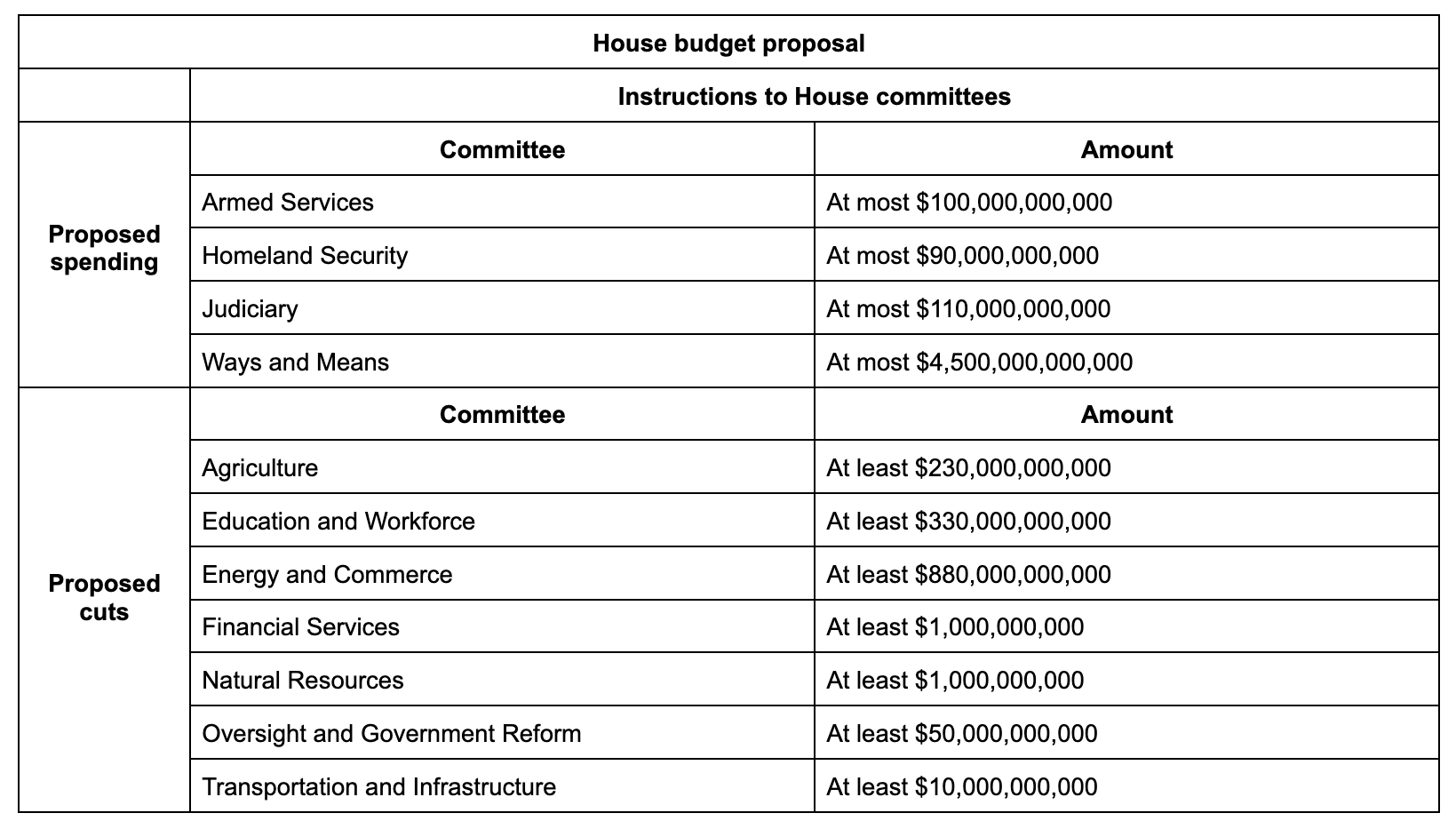

Here’s a table breaking down where House Republicans want committees to spend money, and where they want committees to cut it. I’ll analyze these numbers a bit below.

How is this different from what the Senate proposed?

The Senate’s proposal tees up a two-bill approach to reconciliation, while the House aims to do just one.

The House proposal makes room for massive tax cuts for corporations and the ultra-wealthy. The Senate’s proposal does not.

The House aims to spend a lot more than the Senate does ($4.8 trillion in the House vs. $521 billion in the Senate). Again, this is largely because of taxes.

The House’s proposed cuts are way bigger than the Senate’s ($1.5 trillion with a goal of $2 trillion in the House vs. at least $4 billion in the Senate).

The House wants to raise the debt ceiling by $4 trillion. The Senate’s proposal doesn’t touch the debt ceiling.

What do these numbers mean for services people depend on?

A budget resolution tells which committees to put together parts of the reconciliation bill and how much they must spend or cut—it does not tell committees how to hit those targets. Nonetheless, Republicans have repeatedly previewed those plans (for example, see our January 21 update). Accordingly, there’s a lot we can infer from this new budget blueprint.

Below are some key takeaways from a quick review of the resolution (emphasis on quick—therefore, this list is certainly not exhaustive).

Republicans propose taking health insurance away from families.

How do we know that? The budget directs the House Energy and Commerce Committee to make at least $880 billion in cuts. This committee oversees Medicaid, the health insurer for more than 70 million Americans. Moreover, the resolution states, “it is the goal of this concurrent resolution to reduce mandatory spending by $2 trillion over the budget window.” Mandatory spending refers to spending that Congress doesn’t have discretion over through the annual appropriations process, and includes Medicaid and SNAP. This suggests that these programs have a unique target on their backs.

How would they do that? GOP leaders have proposed creating work requirements for people on Medicaid and “per capita caps” to save money. Data shows that Medicaid work requirements reduce participation in the program considerably—including among people who meet the requirements but are confused by mandated reporting. Reports also indicate that people who lose coverage due to work requirements suffer long-term consequences: data from Arkansas shows that half struggle to pay off medical debt and nearly two-thirds delay taking medications due to their high cost. On top of that, there’s ample data showing that “work requirements” do little to actually promote employment. Regarding per capita caps, the Center on Budget and Policy Priorities has a great explainer. Briefly, these would limit how much money the federal government gives each state for Medicaid, based on a fixed amount per person. Since this cap rises more slowly than actual health care costs, states would be forced to kick people off the program and/or cover fewer health care services. The Congressional Budget Office found that, ultimately, this could force more families into bankruptcy and medical debt.

Republicans propose taking food assistance away from families.

How do we know that? The House proposal tells the Agriculture Committee to find $230 billion in cuts. This committee oversees the Supplemental Nutrition Assistance Program (SNAP), often called “food stamps”—a program that feeds more than 40 million Americans. Moreover, again, the resolution states, “it is the goal of this concurrent resolution to reduce mandatory spending by $2 trillion over the budget window.” This is an oblique reference to Medicaid and SNAP.

How would they do that? Like Medicaid, SNAP has long been a GOP target for work requirements. Data shows that work requirements reduce SNAP participation by more than half, that unhoused adults are disproportionately barred from the program, and that work requirements are rooted in racist tropes and myths that disproportionately harm Black families.

What to watch next

The House Budget Committee plans to vote on this resolution tomorrow. After that, the House is scheduled to recess for a week. Here are a few questions to keep in mind as the House takes its next steps:

How does this thing age over the next week? Assuming this makes it through the House Budget Committee tomorrow, members will go home on Friday for a week in their home districts. At the same time, analysts and reporters will dig into—and publicize—the effects this budget resolution could have on American families. Republicans learned the hard way when they tried to repeal the Affordable Care Act that letting proposals like this sit out there tends to make passing them much harder. I get into that more in our January 10 update. To that end…

Can this even pass the House? House Republicans have a three-seat majority. That’ll shrink to two seats if/when Rep. Elise Stefanik (R-NY) is confirmed to the cabinet. Yet 49 House Republicans have never voted to raise the debt limit, and a failed House vote last year demonstrated that GOP members are willing to buck President Trump on this issue. That’s just one of the issues at play where House Republicans are facing intraparty disagreements. Indeed, just yesterday, the Freedom Caucus threatened to release its own budget proposal. If the GOP doesn’t settle those disputes, this might not even make it through the House.

Will these cuts get bigger? The language around cuts says “not less than.” Coupled with House Republicans’ stated goal of $2 trillion in cuts, we could see even more slashing than the table above suggests if this proposal moves forward.

Which tax policies make the cut? If this blueprint indeed provides the basis for a reconciliation package, the GOP might need to reprioritize its tax wishlist. In May 2023, the Congressional Budget Office said just renewing the tax policies in the 2017 Trump tax package would cost at least $4.6 trillion, and likely more. This means the $4.5 trillion proposed here may not cover even that, to say nothing of the other items on the GOP tax agenda, like further slashing the corporate tax rate and ditching the estate tax altogether. That math only gets tougher for the GOP if they can’t achieve their goal for $2 trillion in cuts and have to pare back their tax goals accordingly.

Which approach wins out—the House or Senate? The House and Senate must approve the same budget resolution to move forward with the reconciliation process. As I described above, right now they’re really far apart. As a reminder, in telling specific committees to write parts of the bill, the budget resolution defines the universe of topics the bill can cover. The final bill is only going to include policies that fall under those committees’ jurisdiction. So, this question of which approach wins out is really a question of which parts of the GOP agenda might advance—and which might not.

To get our quick analysis as this process continues on Capitol Hill, sign up for future Unrig the Rules updates here! If you’d like a live update for your group or coalition, reach out to catherine@progressivecaucuscenter.org. Thanks!